With healthcare costs rising and reimbursement rates tightening, it’s crucial for medical practices to ensure they’re accurately compensated for the services they provide. One key to protecting your revenue is knowing how—and when—to use CPT modifiers that support legitimate increases in reimbursement.

When used appropriately, it tells payers that a procedure took substantially more effort, time, or resources than usual. But submitting it without proper documentation? That’s a fast track to denial.

As a trusted medical billing company, we help practices avoid revenue leakage and optimize claim outcomes. In this blog, we’ll walk you through Modifier 22, how to use it correctly, and how our billing experts can help you get reimbursed what you rightfully deserve.

What is Modifier 22?

Modifier 22 is a two-digit code you append to a CPT code to report that a procedure or surgery required significantly more work than typically expected.

It doesn’t apply to every longer-than-usual case. This modifier is for extraordinary circumstances—cases that demand notably more time, complexity, or technical skill.

When used correctly and backed with solid documentation, it tells the payer:

“This wasn’t a routine procedure. We went above and beyond—and we’re entitled to fair compensation.”

When to Use Modifier 22

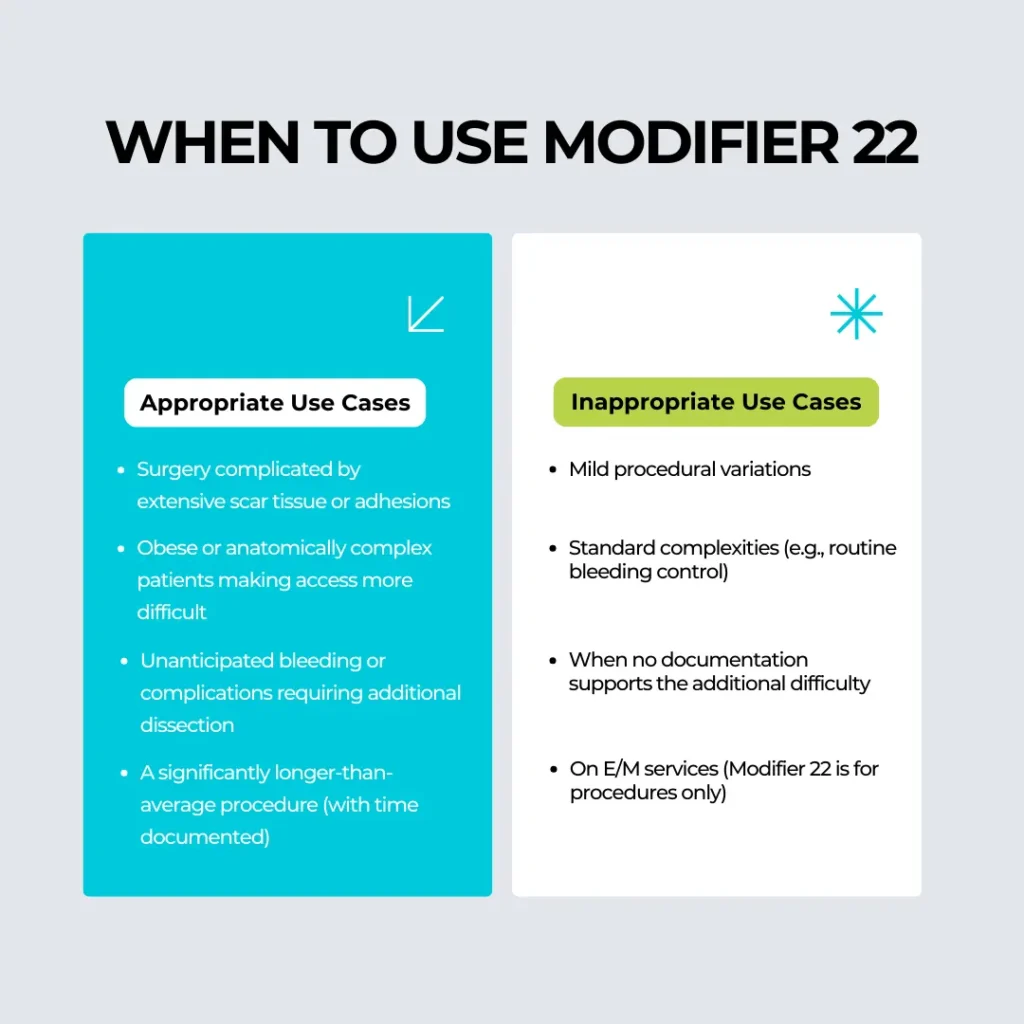

Our billing experts see many cases where it is either overlooked or misused. Here’s a quick guide:

Key Takeaway: Only use when there’s a clear, clinical reason that adds measurable complexity to the work performed.

Why Most Modifier 22 Claims Get Denied

Insurance payers scrutinize Modifier 22 claims very closely. Most are denied because:

- Documentation is vague or missing

- The added effort is not significant enough

- No comparison is made between standard and actual time

- The modifier is applied inappropriately (e.g., to E/M codes or add-on codes)

As a medical billing company, our job is to ensure that it is only used when warranted, and backed with bulletproof documentation. We act as your compliance shield and revenue protector.

Our Proven Process for Handling Modifier 22

When your procedure legitimately requires Modifier 22, our billing experts follow a proven workflow to ensure optimal outcomes:

1. Code Selection & Modifier Placement

We ensure Modifier 22 is appended only to the primary CPT code for the procedure. It should never be used with E/M services or add-on codes.

2. Documentation Review

Our team works with your clinical staff to review the operative report or procedure notes. We ensure that:

- The increased effort is clearly explained

- Start/stop times are included

- Any complications, anatomical variations, or additional resources are described

3. Custom Cover Letter (If Required)

We help you create a summary letter to submit with the claim, highlighting the key points that justify the modifier. This helps payers process the claim faster and more favorably.

4. Payer-Specific Knowledge

Different payers have different expectations. Our billing team is well-versed in payer-specific guidelines for Modifier 22 and submits claims accordingly.

5. Appeals & Follow-Up

If a claim is underpaid or denied, we promptly initiate the appeal process, backed by robust documentation and our in-house payer communication protocols.

How Modifier 22 Impacts Reimbursement

Payers typically manually review claims with Modifier 22. If approved, the reimbursement can be increased by 20% to 30%, depending on the payer and procedure type.

However, if documentation is lacking, they may:

- Pay the standard amount (ignoring the modifier)

- Request additional information

- Deny the claim entirely

Our team helps ensure your claim doesn’t fall through the cracks. We not only protect your revenue—we help you maximize it.

Real-World Example

Case: A general surgeon performed a laparoscopic cholecystectomy. Upon entering the abdominal cavity, they encountered severe adhesions from a previous appendectomy. The procedure took nearly 2.5 hours instead of the usual 45 minutes and required careful dissection.

Solution: We added Modifier 22 to the CPT code 47562, included the operative note with exact times and challenges, and submitted a cover letter outlining the added complexity.

Result: The claim was approved with an additional 25% reimbursement from the payer.

Benefits of Partnering with a Medical Billing Service for Modifier 22

Most providers don’t have the time to navigate coding nuances and payer-specific rules. That’s where we come in.

Here’s how we help:

- Reduce denied or underpaid claims

- Maximize reimbursement when complexity is justified

- Ensure Modifier 22 is used compliantly

- Save time with payer follow-up and appeals

- Educate staff on documentation best practices

Modifier 22 is just one of many coding opportunities practices miss. Our medical billing and coding specialists are trained to identify every modifier, rule, and nuance that can support clean, compliant claims—and higher revenue.

Final Thoughts

Modifier 22 is a valuable tool when used properly—but also a red flag for auditors when misused. To ensure it works for your practice rather than against it, you need:

- Correct documentation

- The right coding decisions

- Right billing partner

We specialize in helping medical practices get paid fully and fairly—and using Modifier 22 is just one way we do it.

If you’re unsure whether your billing team is leveraging all opportunities for maximum reimbursement, we’d love to help.

Looking for medical billing services for small practices? Reach out and let’s ensure you’re not leaving money on the table.