Effective medical billing hinges on accurate insurance verification and timely pre-authorization. A missed approval can halt payments, increase denials, and erode patient trust. Partnering with a reliable medical billing company ensures your front-desk and clinical teams verify coverage before any service begins. By confirming benefits up front, practices improve cash flow and patient satisfaction.

The pre-authorization process secures payer agreement for a procedure or treatment in advance. Without it, payers flag unapproved services and reject claims. Understanding insurer policies and maintaining detailed documentation keeps denials at bay and streamlines revenue collection.

Training staff to recognize authorization requirements is vital. When your team knows which services need approval, they gather necessary provider orders and clinical notes on day one. This proactive approach prevents last-minute scrambles and repeated denials.

What Is Pre-Authorization and Why It Matters

Pre-authorization—also known as prior authorization or precertification—is the insurer’s sign-off on specific treatments before delivery. This step verifies a patient’s coverage for high-cost or specialized services. Payers typically require:

- Clinical justification (diagnosis codes, physician notes)

- Detailed service descriptions

- Supporting test results or imaging reports

Securing approval up front reduces administrative burden. It avoids claim rework and appeals that tie up billing teams for weeks. When payers agree in advance, practices gain clarity on out-of-pocket costs. This transparency enhances patient loyalty and reduces surprise bills.

When to Seek Pre-Authorization

Knowing when to seek pre-authorization helps practices avoid denials. Generally, any service with high unit cost or specialized coding triggers an approval requirement. Common scenarios include:

- Advanced imaging (MRI, CT scans)

- Inpatient admissions and complex surgeries

- Specialized medications and injectables

- Durable medical equipment (CPAP, prosthetics)

Integrating authorization checks into scheduling workflows ensures staff never miss a request. Simple electronic prompts in your practice management system guide team members through required payer portals. Early benefit verification uncovers exclusions and formulary limits before the patient arrives.

Want more information? Read here: Choosing the Right Medical Billing Solution for Your Practice

Common Triggers for Denials Due to Missing Approvals

Failures in pre-authorization often occur when practices overlook subtle payer rules. These triggers include:

- Incorrect service codes: Using outdated CPT or HCPCS codes flags requests for review.

- Incomplete clinical data: Missing physician orders or lab results delays determinations.

- Network restrictions: Out-of-network providers require separate approvals.

- Age and diagnosis limits: Payers impose age ranges or diagnosis criteria for certain therapies.

Standardizing intake forms and checklists prevents these oversights. Educate schedulers on payer-specific requirements and update your payer policy guide monthly.

Best Practices to Streamline Pre-Authorization

To streamline pre-authorization, follow these best practices:

- Centralize requests: Assign a dedicated authorization specialist.

- Verify benefits at scheduling: Confirm coverage before sending appointment reminders.

- Use standardized checklists: Ensure every request includes diagnosis codes, physician notes, and test results.

- Automate reminders: Set calendar alerts for pending approvals and upcoming expirations.

- Audit regularly: Review denied claims to identify recurring errors.

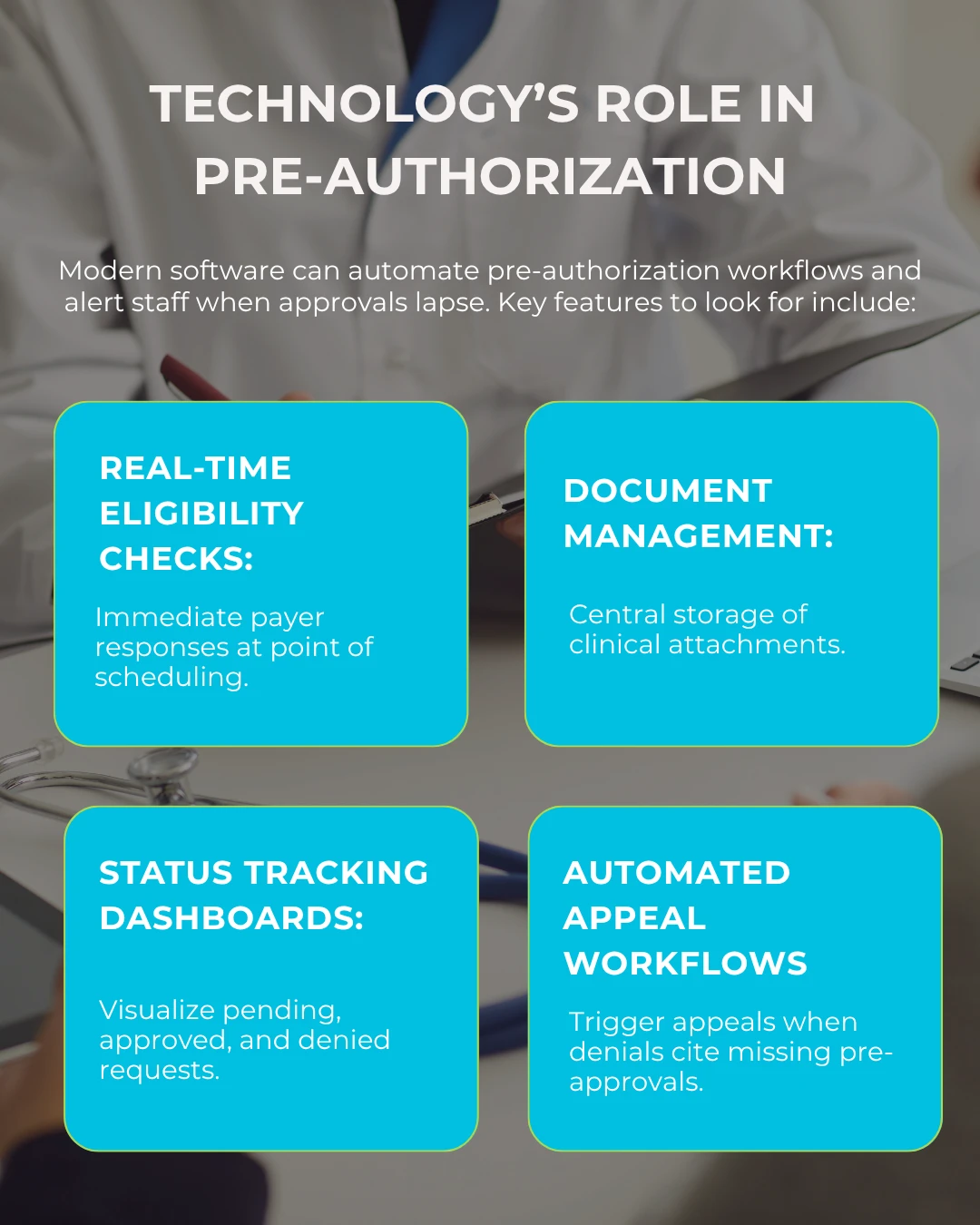

Investing in robust revenue cycle management services ties these steps into a cohesive workflow. Automated systems flag missing data and route requests to the right team member instantly.

By integrating authorization tools with your EHR and billing platform, you eliminate manual data entry and accelerate decision-making. Faster turnarounds mean services proceed as planned and claims submit on schedule.

Measuring Success with Pre-Authorization Metrics

Track pre-authorization metrics to evaluate process effectiveness:

- Approval turnaround time: Average days from submission to determination.

- Approval rate: Percentage of requests approved versus submitted.

- Denial rate for missing approvals: Share of claim denials citing lack of prior authorization.

- Appeal success rate: Percentage of overturned denials after appeal.

Review these key performance indicators monthly. Use findings to refine workflows, update payer guides, and justify investments in automation.

Addressing Common Pitfalls

Lack of pre-authorization remains a top cause of denials. Overcome this by:

- Keeping payer policies current: Subscribe to payer bulletins and update your policy manual.

- Standardizing communication: Use templated request letters to ensure consistency.

- Cross-training staff: Ensure backup coverage when your authorization specialist is absent.

- Leveraging third-party support: Outsource peak volume requests to maintain turnaround times.

Consistent policy adherence and proactive communication with payers prevent process breakdowns and protect revenue.

Conclusion

Prioritizing pre-authorization transforms your revenue cycle health. By confirming coverage before service delivery, you cut claim denials, accelerate payments, and boost patient satisfaction. Implement structured workflows, leverage automation, and monitor key metrics to sustain improvements. With a solid authorization strategy in place, your practice can focus on delivering quality care rather than chasing unpaid claims.

For clear guidance on Type of Service coding, review the TOS full form in medical billing and ensure every request meets payer expectations.

(FAQs) Frequently Asked Questions

Q1: What triggers pre-authorization?

High-cost imaging, specialty drugs, inpatient stays, and durable medical equipment often need approval before service.

Q2: How long does pre-authorization take?

Turnaround varies by payer but generally takes 2–14 days. Automated portals may speed this to 24–48 hours.

Q3: Can denied pre-authorization be appealed?

Yes. Submit clinical documentation, peer-to-peer reviews, and any additional test results to support your case.

Q4: Does approval guarantee payment?

Approval confirms medical necessity but does not guarantee full reimbursement. Accurate coding and timely claim submission remain essential.

Q5: How do I reduce denials from missing pre-authorization?

Automate eligibility checks, centralize requests, use standardized checklists, and audit denials to identify process gaps.